A Checking Account and So Much More

Central Plus Checking is the ultimate financial companion. It goes beyond the basic checking account to provide you with comprehensive security and convenience. Go beyond managing your finances, and live life to the fullest with the following benefits.

Central Plus Checking Benefits

Receive all the benefits of an ICCU checking account PLUS more! For a small monthly fee of $7, make life smoother with access to amazing benefits. Open a Central Plus Checking Account today and see why this is more than just any other checking account.

- Free instant-issue Visa Debit Card

- Free mobile & online banking

- Free early access Direct Deposit – get paid up to 2 days early

- Free credit report, credit score, and more with My Credit

- Amazing benefits and perks that provide security and convenience

Have questions on how to upgrade a current checking account to a Central Plus Checking Account? View our step-by-step instructions.

Minimum Balance to Open

$100

Minimum Daily Balance

$0

Monthly Service Fee

$7 (First Month Free)

Telehealth

Access to 24/7 video or phone visits with U.S.-based board-certified, licensed and credentialed doctors ready to help with urgent care or mental health for you and your family — all with zero copays.

(Registration/activation required).

Cell Phone Protection

Receive up to $600 of replacement or repair costs if your cell phone is stolen or damaged, in the U.S. and abroad. $50 deductible applies. Up to two claims occurrences per eligible account and maximum of $1,200 per 12-month period.

Travel & Leisure Discounts

Money-saving discounts from thousands of local and national businesses. Members can redeem and print coupons online or access discounts from a mobile device. Digital access makes saving super easy and convenient, giving instant savings anywhere, and anytime.

(Registration/activation required).

Roadside Assistance

24-hour coverage for roadside assistance services including vehicle towing, fuel/oil/fluid/water delivery, and battery/lock-out/tire assistance up to $100 per occurrence. Maximum of two occurrences per twelve-month period.

(Registration required).

Identity Theft Services

If your identity is stolen, we have you covered. A dedicated fraud specialist will manage and resolve suspected or confirmed fraud until completion. In addition, Identity Fraud Expense Reimbursement Insurance covers up to $1,000,000 of your out-of-pocket expenses incurred during the recovery of your identity. Did we also mention that your personal information will be monitored on the dark web and you’ll receive alerts when your personal information is exposed! Just another benefit of your Central Plus Checking Account.

Debit Advantage

Receive coverage on Central Plus Checking purchases for 90 days from the date of purchase against accidental breakage, fire or theft. In addition to extended warranty’s up to one full year on most new retail purchases if the warranty is less than five years.

Health Discount Savings

Enjoy savings on vision, prescriptions, and dental services. This is NOT insurance.

(Registration/activation required).

Additional Perks

With an ICCU Checking Account, the benefits go on and on. You’ll get even more tools and services. Not to mention the great care and service we provide to each individual member. It’s just another way we’re looking after your daily balance.

Love the Convenience

Take Control

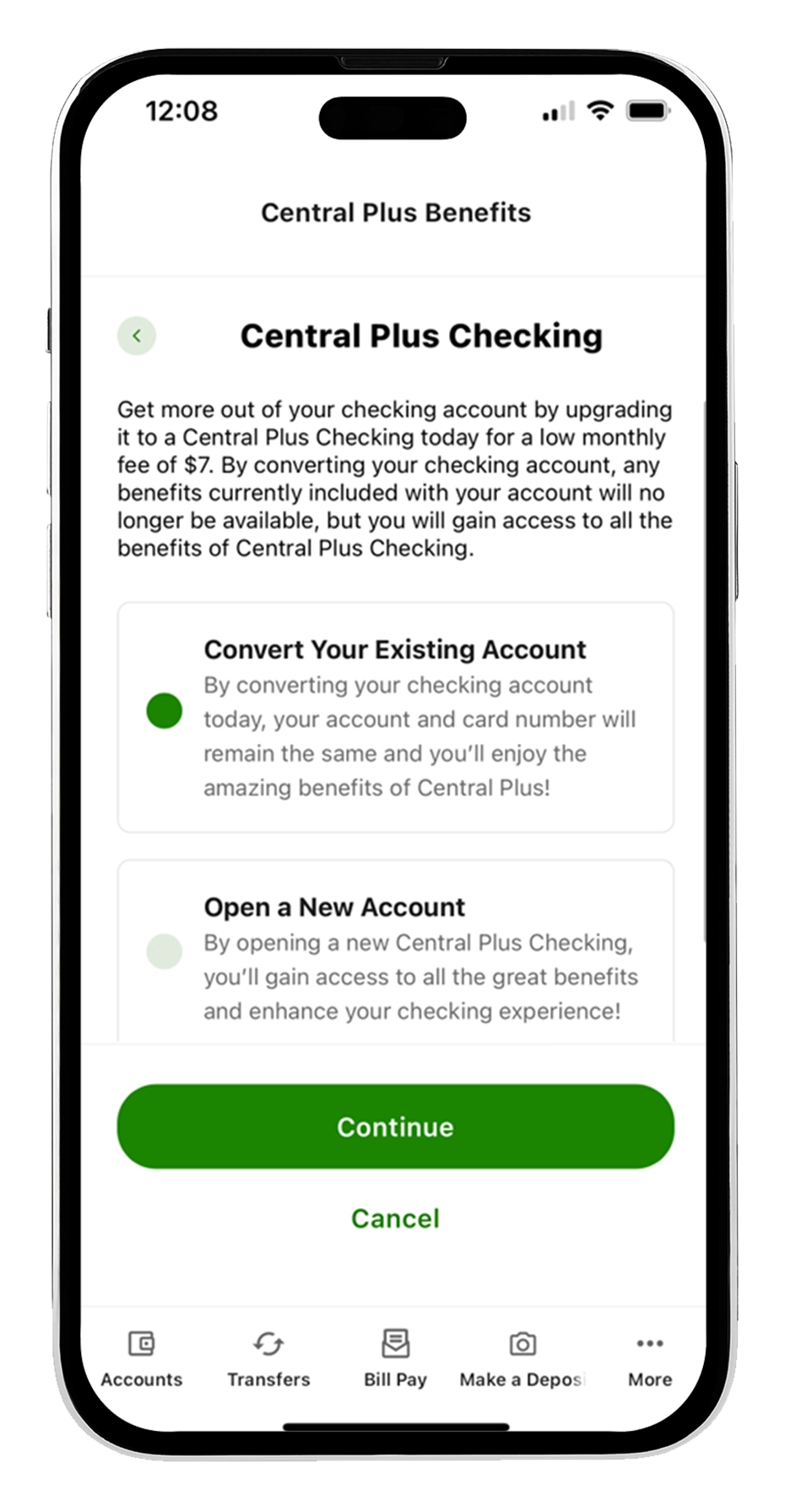

How to Convert Your Existing Checking Account

Step 1:

Log into eBranch Online Banking

Once you are logged in navigate to the “Central Plus Benefits” link located in the “Accounts” tab. Next, select the “Upgrade to Central Plus” option. Once selected click “Continue.”

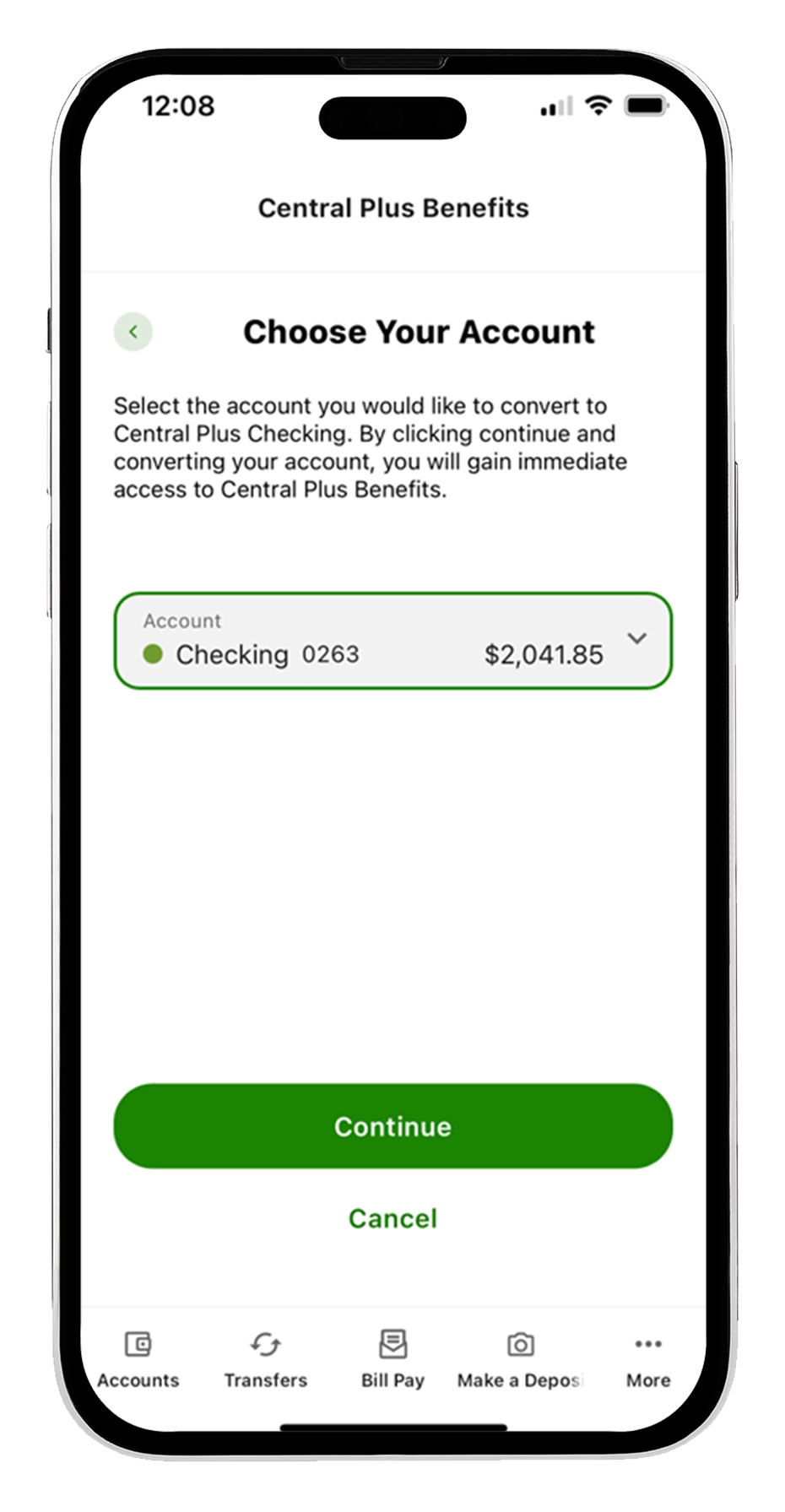

Step 2:

Choose your account

From here, select which account to upgrade into a Central Plus Checking by clicking the dropdown field. Once you have chosen an account select “Continue.”

Step 3:

Celebrate your new account!

Voilà! You have successfully converted your existing checking account into a Central Plus Checking Account. Now you can enjoy your amazing new benefits.

Eligibility Disclosure: Benefits above are available to personal checking accounts and their primary accountholder and joint accountholder(s) subject to the terms and conditions set forth in the Guide to Benefit and/or insurance documents for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an accountholder or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students.

1. Available for the account holder and their spouse/domestic partner and up to six (6) dependent children age 2 and older. This is not insurance.

2. Special Program Notes: The description herein is a summary only and does not include all terms, conditions and exclusions of the Benefit described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit and/or insurance documents. Log in to your ICCU Online or Mobile Banking and connect to your Central Plus Checking benefits for Guide to Benefit or to file a claim. Insurance Products are not insured by the NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.