Certificates of deposit (CDs), like all savings accounts, come with pros and cons. If you’ve read our previous article about CD basics, you know that a certificate of deposit can give you access to a higher interest rate … at the cost of limited access to your money. If that sounds like too high of a price, a CD laddering strategy might be the best choice for you.

What is CD Laddering?

A CD is a savings product that gives you a fixed rate for a fixed amount of time. Members who prefer low-risk savings options tend to love CDs for their predictable returns.

CD laddering is a strategy that can give you quicker access to your funds. Instead of locking your money away in one CD for, say, five years, you divide that money into multiple CDs, each with a slightly shorter term. As each CD matures, you can either pull that money out or roll it into a longer-term CD. This strategy is generally used for long-term savings (think years), but many have found success in opening mini CD ladders as well.

What is a mini-ladder?

Because CDs with longer terms tend to have higher interest rates, a typical laddering strategy includes CDs that span years rather than months. In contrast, a mini-ladder uses CDs that span months, which can lead to more flexibility and less overall savings. If you’re just dipping your toes into the world of CD laddering, this could be a good option for your first ladder.

How to Build a CD Ladder

Step 1: Open multiple CDs

Let’s pretend you have $10,000 you’re considering putting into a CD. If you deposit that money into one 5-year CD, you’ll get one fixed rate of return and one chance to withdraw that money without a penalty — when it matures after five years. If instead you decide to ladder multiple CDs, you can access that money once every year.

To set up a CD ladder, you need to open several accounts at once, each with a different term:

- 1-Year CD: $2,000 deposit

- 2-Year CD: $2,000 deposit

- 3-Year CD: $2,000 deposit

- 4-Year CD: $2,000 deposit

- 5-Year CD: $2,000 deposit

Step 2: Reinvest your CDs as they mature

When a CD’s term ends, it enters a period called maturity, where you have limited time to reinvest the money in a different account, withdraw the funds, or let the account automatically renew (usually for a similar term at the current standard rate). If you’re interested in a traditional CD laddering strategy, you’ll pick the first option and reinvest the money in a different CD.

When that 1-Year CD matures, withdraw the funds and reinvest them in your longest-term CD so your accounts look like this:

- 2-Year CD: $2,000

- 3-Year CD: $2,000

- 4-Year CD: $2,000

- First 5-Year CD: $2,000

- New 5-Year CD (formerly 1 Year): $2,000

Continue this as each CD matures.

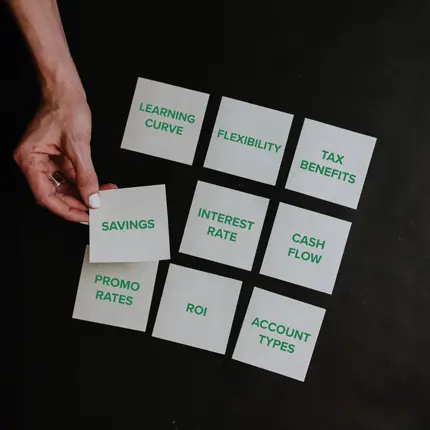

Pros and Cons of CD Laddering

Depending on each member’s goals, CD laddering can be a great option for some and less ideal for others. Your best bet is to weigh the pros and cons, prioritizing the choice that best seems to fit your savings goals.

The Pros

- Higher rates: CDs usually have better interest rates than a typical savings account.

- More cash flow: CD laddering gives you more opportunities to withdraw your money without penalty.

- Added flexibility: Because you have more cash flow, you have more options when a CD matures. You can decide whether you want to reinvest the money at the end of each CD’s term, giving you a great back-out option if your savings goals change.

- Opportunities to land a better rate: Interest rates can fluctuate over time. If the rates go up after you get a CD, you can jump on a better rate as soon as your shortest CD matures. If rates drop, you can stick with your current rate.

The Cons

- Can be complicated to manage: In this case, more accounts equal more complexity. If you choose to ladder your CDs, you’ll need to track your maturation dates. If you miss a maturation date, your CD could restart but at the current standard rate — giving you less freedom and fewer savings than other account types might. If you’re fine with a complex investment strategy, this may not be much of an issue.

- Little access to short-term promotions: Promo CD rates can be higher than even long-term CD rates but usually don’t stick around. If your money is already locked in a CD and your maturity date isn’t on the horizon, you won’t be able to take advantage of that better promo rate. If this worries you, consider creating a mini-ladder rather than a traditional laddering strategy.

- No special tax benefits: Some savings products can offer extra tax benefits, but a CD isn’t one of them. If you’re in a high-tax bracket, you may want to consider a different savings approach.

Is CD Laddering Worth It?

That depends on several factors, like what kind of investor you are and what the market looks like. CD ladders tend to benefit people looking for stable investments in a volatile market. It’s a great middle-of-the-road option — this type of investment likely won’t bankrupt you or make you rich overnight; instead, it’s best used for people who want to cushion their existing savings.

If you’re looking to increase your emergency savings, a different account type (like a Central Cents or High-Yield Online Savings Account) could be a better choice. CDs don’t offer the flexibility and cash flow needed for emergency savings. If you need to pay for an unexpected car repair, for example, you’ll want easy access to that money, unlike a CD or CD ladder, which locks your money away for long periods of time.

If, on the other hand, you’re looking to take advantage of high interest rates for additional savings, a CD ladder could be exactly what you’re looking for.