Saving for retirement can feel a lot like starting an important project… only to realize that your user manual is written in a foreign language. The tools you need are staring right at you, but you have no idea how to use them to accomplish your goal.

Many prospective retirees feel overwhelmed by the task ahead of them, and it’s no wonder. After all, recent studies show that women have saved an average of $57,000 for retirement, and men have saved $118,000. Yet many retirement experts recommend a total savings of around $1 million.

We’ve partnered with Retirement Simplified powered by Silvur to put control back in your hands, on your terms. Retirement Simplified speaks your language as it teaches you how to retire. Use the tips (and downloadable checklist) below to learn how you can prepare for retirement — no matter what your savings look like now.

(Psst … ICCU members get FREE access to Retirement Simplified. Not a member? Sign up for ICCU today.)

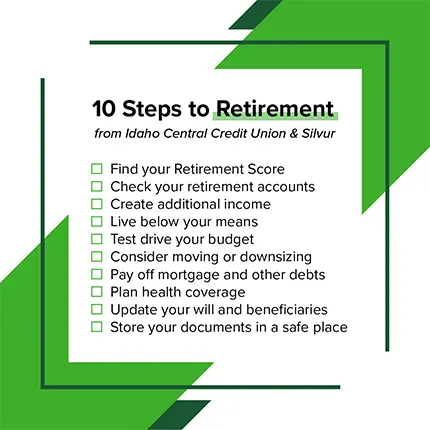

Your Retirement Checklist

There are a lot of moving parts involved in retirement prep, which can make the whole process a little hard to digest. But if you break the big ol’ retirement elephant into a few bite-sized chunks, you may find that your retirement goals are more achievable than you thought.

We designed this 10-Step Retirement Checklist to help you do just that. Use this list as a jumping-off point and keep in mind that you’re in control of your own financial journey. Feel free to rearrange these items to better fit your circumstances and objectives.

(Download the 10-Step Retirement Checklist)

To learn about how retirement recommendations can differ by age, check out Retirement Simplified’s guides to retiring by 60, 65, or 70.

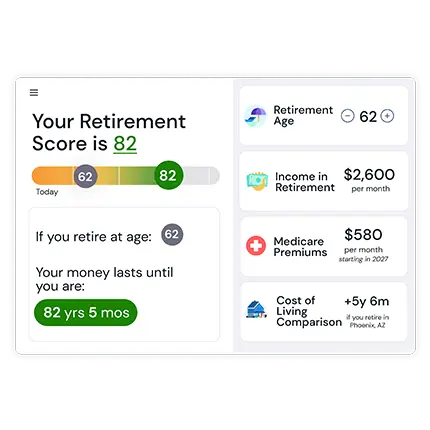

Retirement Simplified’s Retirement Score Explained

Ready to tackle the first step of retirement prep? Retirement Simplified’s Retirement Score is a good place to start. In about 5 minutes, Retirement Simplified can give you a personalized estimate of when you can retire, plus when (or if) your retirement savings will run out.

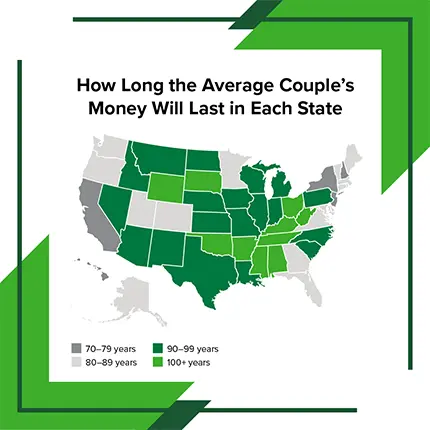

Source: Retirement Simplified powered by Silvur

We recommend checking your score whenever you hit a major milestone — that way, you can see how each financial decision affects your retirement. Check your score now to get a baseline measurement, then watch your score improve as you prepare to retire.

How It Works

As an ICCU member, checking your Retirement Score is quick and easy. Retirement Simplified will ask you a few get-to-know-you questions, like your name, age, and expected retirement date. To give you an accurate prediction, it will also ask about existing income, investments, and contributions. (Estimates are fine!) Rest assured, Retirement Simplified will NOT ask for sensitive information like SSNs, driver’s licenses, or bank account numbers.

How to Budget for Retirement

Just like any good savings plan, your retirement budget should include two main things: income and expenses. But that’s where the similarities end. With unique accounts, extra regulations, and limited income, retirement budgeting can become a tricky beast. Here’s how to tackle it.

Find Creative Sources of Income

Whether you genuinely enjoy working or just like the extra money and benefits, a part-time job can drastically extend your retirement savings. In fact, your experience and knowledge can help you find a variety of job opportunities:

- Freelancing or contracting: Best for people who want flexible hours and rates

- Teaching or tutoring online: Best for social people who want mind-intensive work

- Managing rentals: Best for organized people with extra time on their hands

- Retail: Best for people who want consistent hours and paychecks

(Read: Working Part Time Impacts Your Benefits)

If you don’t plan on working during retirement, passive income might be a good alternative. Unlike wages, passive income typically generates revenue on its own and doesn’t require daily effort to maintain. Examples include:

- Royalties from creative work

- Rental income

- Online courses and e-books

Keep in mind that passive income can be more difficult to obtain and less reliable than an hourly wage. But when combined with time and preparation, it has provided many retirees with financial independence.

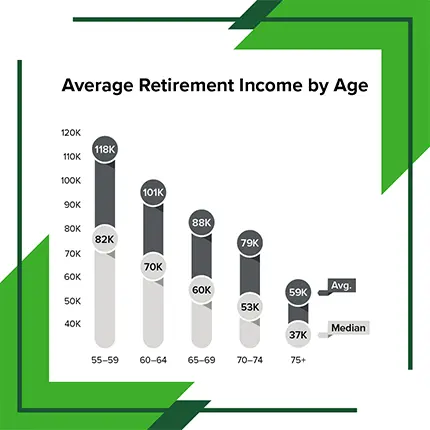

Data is provided by The United States Census Bureau (2021). Median and average incomes are rounded to the nearest thousand.

For most, income also includes contributions from various accounts, like a pension fund, traditional 401(k), or Roth 401(k). To track those contributions, contact your current and previous employers. Their HR departments should give you access to your account balances and payment histories. Keep track of your logins so you can access the accounts later — we recommend checking them at least every six months.

(Read: Social Security 101)

Minimize Expenses

No matter which way you slice it, retirement is ultimately one thing: expensive. While retirees tend to spend less than workers in categories like food and housing, they face much higher medical and insurance costs, to name a few.

To plan for that shift in spending, you should first envision what you’d like your retirement to look like. Do you, for example, expect to travel more? If so, it might be wise to set up a high-yield savings account now to prepare for those future costs.

When calculating your retirement expenses, consider these factors:

- Cost of living: Where you live can affect the cost of food, entertainment, housing, and more. Use Retirement Simplified’s Cost of Living Calculator to compare locations.

- Housing/relocation: If you plan to move or downsize, add those expenses to your retirement budget. Consider moving before you retire so you can get better mortgage options. (Lenders tend to look for regular income when approving loans.)

- Existing debts: If possible, minimize your recurring payments before retiring. You’ll feel more in control of your retirement without the burden of a mortgage, car payment, or other debts weighing you down.

- Healthcare: A basic health plan typically doesn’t cut it in retirement. To prepare for more frequent medical expenses, Retirement Simplified recommends fully funding a Health Savings Account (HSA) before you retire. Learn more about healthcare options later in this article.

- Taxes: Because most retirement accounts have different taxation policies, you’ll need to review your own accounts to better understand what taxes you’ll owe on your savings. For more info, check out Retirement Simplified’s guide on how to lower your taxes in retirement.

Numbers are provided by Retirement Simplified. Because most couples retire at different ages and with different savings, we suggest you use this chart for general cost-of-living comparisons rather than a hard and fast rule. Find your Retirement Score for a more personalized estimate.

Put Your Budget to Work

Once you’ve got the nitty gritty details of your income and expenses settled, it’s time to give it a test drive. Though you may not be able to test out everything in your retirement plan — like Social Security and other contributions — you can see if you’ve set a reasonable budget in other ways.

First, calculate your expected monthly spending allowance, then try to live off that amount for 4–6 months.

This is a risk-free way to get a glance into the future of your retirement. If, after a few months, you realize your estimates were off, no worries! Better to have that info now than later. Make a few adjustments and try again until you get it right.

Meanwhile, you can put any extra earnings into an emergency fund, which will be an invaluable resource as you transition from your full-time job.

How to Prepare for Healthcare Costs in Retirement

If you’ve ever researched healthcare costs in retirement, you probably know that the recent pandemic and inflation spike have made things look pretty bleak. According to a 2022 data report by HVS Financial, the average 65-year-old couple’s retirement healthcare costs will likely increase by nearly $86,000 for a grand total of $673,587. Scary, right?

But before the panic sets in, it’s important to remember two key things:

- First, many stats account for your entire retirement, just like the one above. We’re talking decades, here. Any number is intimidating when you total it up like that.

- Second, you can do this. With a little strategy and preparation, you can manage those costs and take charge of your retirement savings.

Fully Fund Your Health Savings Account (HSA)

Health Savings Accounts are what Retirement Simplified likes to call a triple tax threat. This is because:

- Contributions you make are tax-deductible

- Withdrawals are tax-free if you use the funds for qualified medical expenses

- The account balance grows with tax-deferred interest

The money in an HSA rolls over from year to year. If you retire before 65, Retirement Simplified recommends using your HSA to cover things like long-term care insurance and COBRA premiums. After 65, you can use it for Medicare and most other medical expenses.

(Read: ICCU’s Ultimate Guide to Medicare)

Research Long-Term Care (LTC) and Life Insurance

At some point in your retirement, there’s a good chance you’ll need someone to help you with daily living tasks. That’s where long-term care comes in.

Though it may seem more prudent to save for immediate retirement expenses like housing, don’t let your LTC savings fall by the wayside. By buying LTC coverage as early as your 50’s or 60’s, you’ll generally get more affordable premiums.

To prepare for the cost of LTC, consider getting long-term care insurance. Some life insurance policies include LTC, so if you have a life insurance policy, be sure to check that first.

Wondering if you need life insurance? Retirement Simplified wholeheartedly recommends it. Your policy will act as a safety net for your loved ones if you pass away unexpectedly or are diagnosed with a terminal illness. It can cover basic household costs, medical bills, and final expenses, to name a few.

(Read: Life Insurance in Retirement)

How to Plan Your Estate

Benjamin Franklin’s famous quote, “Nothing is certain except death and taxes,” is unfortunately even truer when you retire. That’s why we recommend getting your important documents in order right before retirement.

Create or update your will, then find a healthcare power of attorney. It’s a big task, but it will give you peace of mind once it’s done. You may also want to add a living will, which will give you more control over your life in case you can’t speak for yourself before you die.

While you’re at it, update the beneficiaries on your various accounts, including bank accounts, insurance policies and retirement funds. Look into pre-paid funeral plans and even a final disposition so you can dictate what will happen to your remains.

If this is all a little overwhelming, you can hire an attorney who can sort most of this out for you. But if you’d like to tackle this on your own, there are a variety of online legal tools that will help.

Note: Store all these important papers in a safe place! Add any documentation you may have on your mortgages, investments, etc., then tell someone you trust about its location.

Take Control of Your Retirement

You’re in charge of how and when you retire. We’re just here to equip you with the right tools to make that retirement a reality. As an ICCU member, you get all the resources listed in this article (and more) for FREE. No catch.

Not an ICCU member? Join today for more financial perks and education.

Download the ICCU app or log into eBranch to sign up for Retirement Simplified powered by Silvur, you’ll get access to dozens of lessons about retirement, including topics like healthcare, taxes, Social Security, and insurance — plus a personalized Retirement Score. Take control of your retirement with ICCU and Retirement Simplified. Your future self will thank you.